You may want to tackle an insulation project first, which is generally low cost but can have a high rate of return on energy savings.

Recently we published an extensive article about the roll out of new state and federal incentives to promote a more efficient electrified lifestyle.

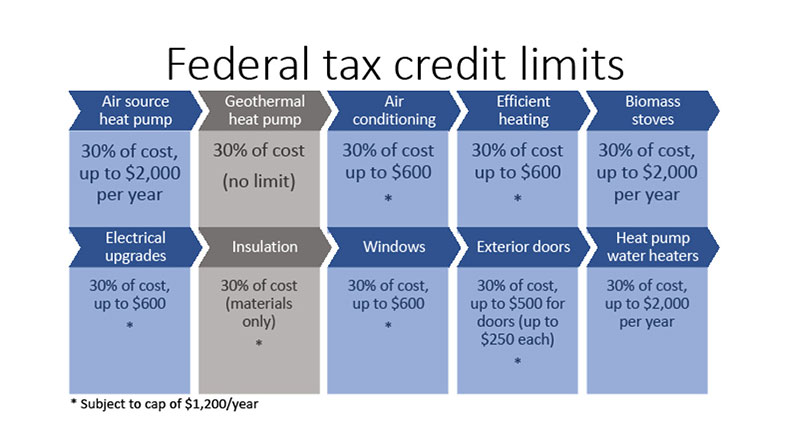

While the state program is not yet up and running, which will target low- and middle-income households, the federal incentives are in full swing. Because these tax credits don’t expire until Dec. 31, 2032, members have the perfect opportunity to develop an individaulized plan of action and check off items on your efficiency to-do list over a number of years.

For example, you may want to tackle an insulation project first, which is generally low cost but can have a high rate of return on energy savings. With those energy dollars freed up and the tax credit being applied you should have more available income to embark on your next efficiency project.

Annual Limits on Energy Efficient Home Improvement Tax Credits

In addition to limits on the amount of credit you can claim for any particular equipment installation or home improvement, there are annual aggregate limits. The overall total limit for an efficiency tax credit in one year is $3,200. This breaks down to a total limit of $1,200 for any combination of home envelope improvements (windows/doors/skylights, insulation, electrical) plus furnaces, boilers and central air conditioners. Any combination of heat pumps, heat pump water heaters and biomass stoves/boilers are subject to an annual total limit of $2,000. (Note: Energy Star-certified geothermal heat pumps are eligible for a separate tax credit and are not counted against these limits.)

Remember: Always consult a tax professional if a tax credit is essential to your budget calculations.

Learn more about your cooperative.