NEW VEHICLES

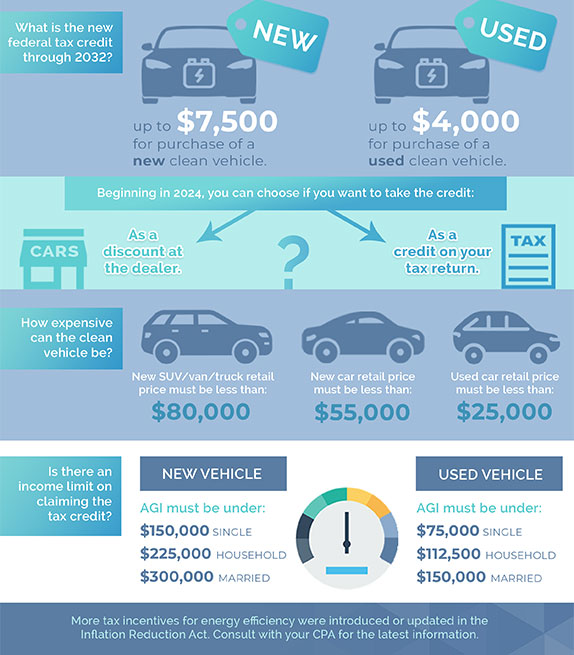

You or your business may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric vehicle (FCV). To qualify, you must buy it for your own use, not for resale, and use it primarily in the U.S.

The vehicle must have a battery capacity of at least 7 kilowatt hours, have a gross vehicle weight of less than 14,000 pounds, and be made by a qualifying manufacturer with final assembly in North America.

USED VEHICLES

As of Jan. 1, 2023, if you buy a qualified used electric vehicle (EV) or fuel cell vehicle (FCV) from a licensed dealer for $25,000 or less, you may be eligible for a used clean vehicle tax credit (also referred to as a previously owned clean vehicle credit). The credit equals 30% percent of the sale price up to a maximum credit of $4,000.

The new and used vehicle credits are nonrefundable, so you can’t get back more on the credit than you owe in taxes. You also can’t apply any excess credit to future tax years. Purchases made before 2023 don’t qualify.

As always, Tideland encourages you to consult a tax professional before purchase if the tax credit is integral to your decision making.

Learn more about your cooperative.